The internal rate of return (IRR) is a core metric for real estate investors. It helps you determine the profitability of certain investments by looking at the percentage of interest you earn on your investment over the course of the holding period.

The Internal Rate of Return Formula

You can use IRR to compare real estate investments with variable payouts and different timelines. For example, let’s say you’re looking at two investments:

- One investment promises to pay you $500 every month for five years until you get your full investment back.

- Another one promises to pay you anywhere between $4000-$7000 a year for six years (depending on performance), with an extra $10k bonus at the end when they refund your entire investment.

Even if we assume the cost is the same, it isn’t clear which investment is better. Internal rate of return is the perfect solution.

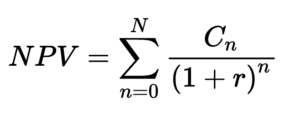

The following formula defines the internal rate of return:

At first, it might look a little confusing, but we’ll show you specific examples of how IRR works in real estate investing so that you can use it to become a better investor. You don’t necessarily need to know each variable in order to use IRR; you just need to get the gist.

Let’s get started.

IRR Example #1: Steady Payments (Coupon)

For our first example, let’s assume you invest $50k in a fund, and it distributes $4k/year for five years. The payment structure looks like this:

- Initial investment: $50k

- Year 1: $4k

- Year 2: $4k

- Year 3: $4k

- Year 4: $4k

- Year 5: $4k

- Return of Capital: $50k

You received $20k in total over 5 years. The IRR is 8%.

This type of investment is sometimes called a coupon. It gives regular payments with the guarantee of a return on your principal.

But what if we make it a bit more confusing? What if the distributions were lower but, at the end of the investment, the fund split the profits with their investors? How might that change the IRR?

IRR Example #2: Steady Payments with Profit at Sale

It might look like this:

- Initial investment: $50k

- Year 1: $3.2k

- Year 2: $3.2k

- Year 3: $3.2k

- Year 4: $3.2k

- Year 5: $3.2k

- Return of principal: $50k

- Share of profit at the sale: $7,892

In this case, you received a total of $23,892. Your IRR is still 8%. Why?

Because IRR takes into account something called “the time value of money.” This is a concept that says a dollar in your hand today is worth more than a dollar at some point in the future.

Therefore, in IRR, regular payments of $4k are better than regular payments of $3.2k, even if you end up receiving up to $7,892 in extra profits at the end of a five-year investment.

Finally, let’s look at an example of an investment with a more variable payment structure: a value-add commercial property.

IRR Example #3: Value-Add Property

An investment in a value-add commercial property might look like this:

- Initial investment: $50k

- Year 1: $0

- Year 2: $0

- Year 3: $3,450

- Year 4: $5,750

- Year 5: $8k

- Return of principal: $50k

- Share of profit: $13,233

For the first two years, since the investors are working on renovations and restructuring, you receive nothing. However, the payout at the end of the 5-year period is the highest of the bunch.

In total, you receive $30,433. The IRR is still 8%. Since the payments occur so late in the investment, the IRR evens them out.

Is a Bigger IRR Always the Goal?

That depends. As you can see in these examples, the value-add commercial property actually gives you the greatest overall return on your investment, even though it technically has the exact same IRR as the first example, which only gives you a total profit of $20k.

If your time horizon is greater than 5 years and you don’t need regular distributions, there’s no doubt that the value-add commercial property is the better investment.

That’s just one example of many to show you that a bigger IRR isn’t always the goal. You should consider many other factors in your analysis — like risk exposure, distribution patterns, overall return, debt structure, and more — and all of those factors should coincide with your overall investing goals.

Conclusion

Internal rate of return, or IRR, is a key metric for real estate investors.

Oftentimes, in the real world, the numbers aren’t quite as clear-cut as they look here. A property or investment with a good prospective IRR might actually turn out to be a money-pit because you failed to consider other factors in your analysis.

In real estate investing, it’s key not to lose your head over one particular deal or metric. IRR is one tool of many that can help make you a better, savvier investor — but don’t rely on it as the only tool.

Thank you for taking the time to read this

If you enjoyed reading this article, I’d love for you to subscribe to our monthly newsletter or share it with a friend!