What risk factors are you exposed to while investing in stocks and real estate? Is the real estate market closely tied to the stock market? If one goes down, won’t they both go down?

If you’re invested in a diversified stock portfolio through index or mutual funds, you can probably expect 8-12% returns before inflation, but you might assume that there’s no additional benefit to investing in commercial real estate. After all, the thinking goes, if the S&P 500 takes a hit, so does commercial real estate, right? The two are intrinsically linked (or are they?). If you have a diversified stock portfolio, many personal finance gurus and economists say it’s similar to investing in the entire US economy, so you might assume there’s no benefit to real estate investing.

So, many retail investors will put their money in bonds, since bond returns are typically an inverse of the stock market to diversify from their S&P 500 investment (or similar).

Besides, with all of the fees and taxes associated with real estate, why would you even bother?

In this article, we’ll look at the risk factors for both real estate and stock investing to show you why, if you’re aiming for a solidly diversified portfolio, some form of real estate investing is key. The S&P 500, along with other major indices, are not necessarily reflective of the market as a whole. Investing in real estate is actually altogether different than investing in the stock market.

And, by diversifying your investments, you can create a steadier, safer portfolio. That means a safer retirement, higher capital preservation, and possibly a better overall return.

How Much of the Real Estate Market is Tied to the Stock and Bond Markets?

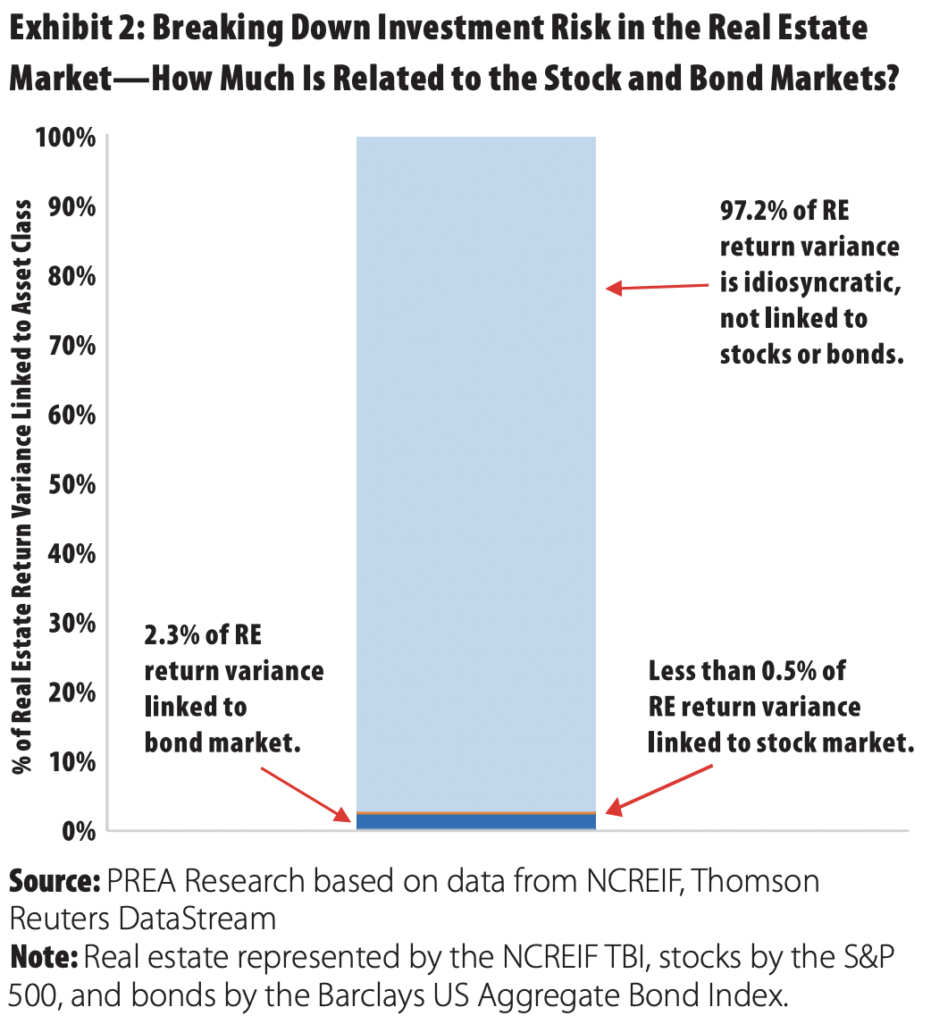

Greg MacKinnon of PREA looked at the differences in returns for the stock market and real estate market and found that there is almost zero correlation between returns in the two markets.

In his words, “Using quarterly returns from 2Q1984 to 2Q2018, Exhibit 2 shows that only 2.3% of the variation of real estate returns is associated with the variation in bond market returns, and only a minuscule slice (less than half a percent) is associated with the variation in the stock market.”

What this means for the average individual investor is that the stock market can be wildly overvalued, with most pundits and economists expecting a downturn in the next couple of years, while the real estate market continues to deliver consistent returns. On the flip side, however, the real estate market could crash and stocks and bonds could remain relatively unaffected.

Key Economic Risk Factors

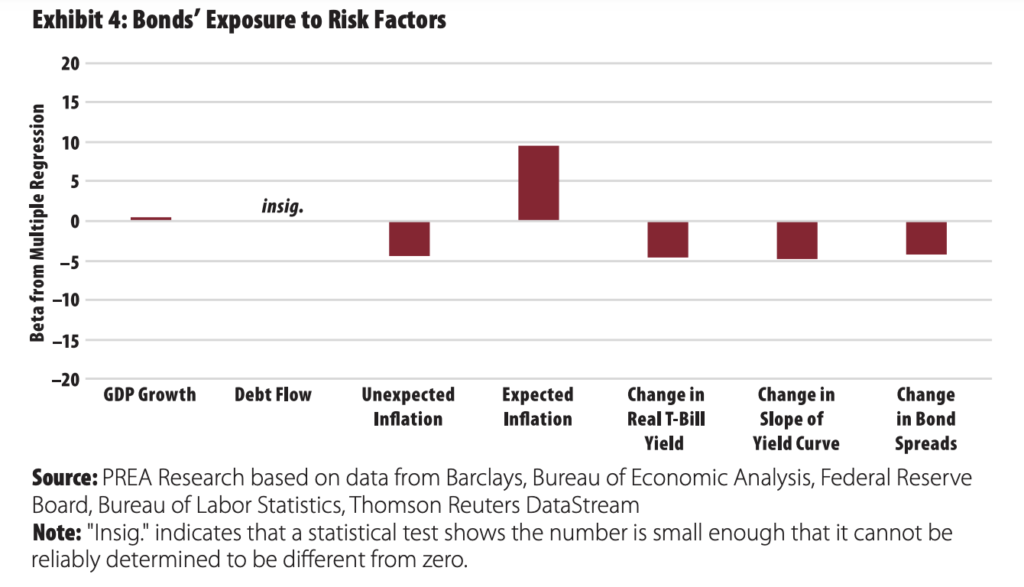

In a recent research article by Greg MacKinnon of PREA, the same one that we talked about above, he looks at six key economic risk factors that are typically associated with stock, bond, and real estate investing:

- GDP Growth

- Debt Flow in Economy

- Inflation

- Change in Real T-Bill Yield

- Change in Slope of Yield Curve

- Change in Bond Spreads

These factors represent the typical movers in the economy: growth, interest rates, inflation, debt spending, and more.

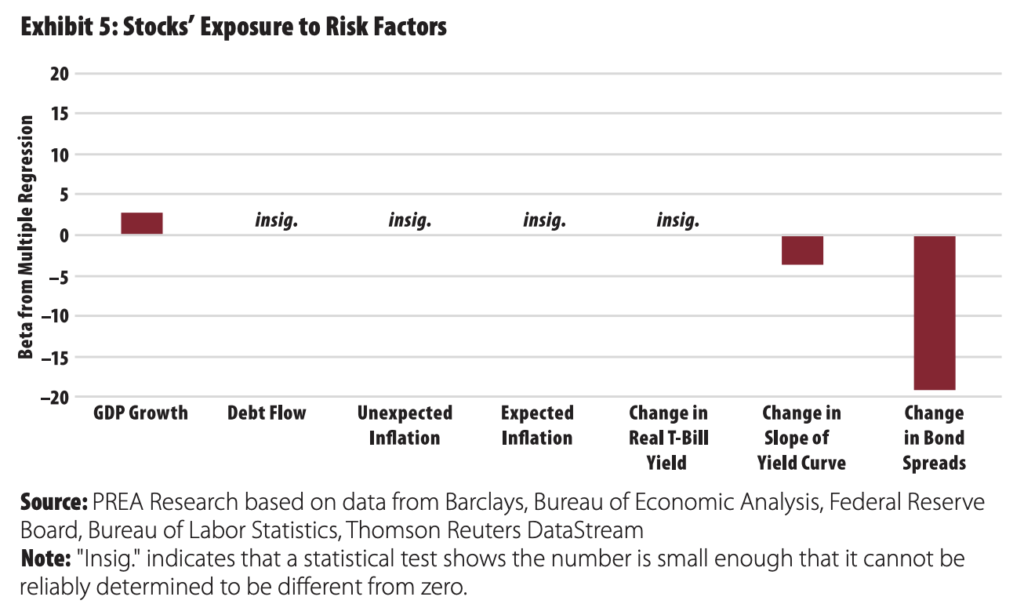

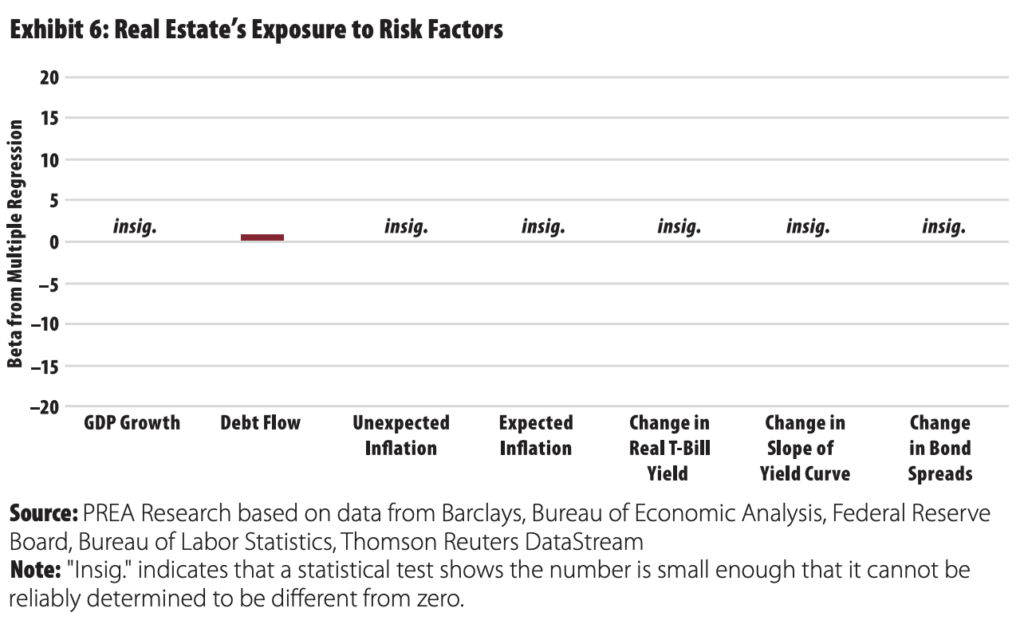

When Greg MacKinnon examined the relationship of these risk factors to the different types of investing, here’s what he found: “real estate’s factor exposure is essentially the opposite of that of the other two asset classes—real estate is not exposed to the factors influencing stocks and bonds but is exposed to a factor that does not influence stocks and bonds. On a macro level, an allocation to real estate is a bet on much different things than are bets on stocks or bonds, the essence of diversification.”

What does that mean for the average retail investor? That a diversified portfolio includes stocks, bonds, and real estate — and that real estate might actually be exposed to completely different factors than the stock market. If the stock market goes up, that doesn’t mean that the real estate market will go up. The inverse is also true when the real estate market goes up.

The Differences Between Real Estate Investing and Stock Investing

MacKinnon found that the only risk factor that directly affected real estate investing was total debt flow in the economy. The others had an insignificant relationship to real estate returns.

Stocks, on the other hand, had a positive correlation with expected inflation and GDP growth and a negative correlation with unexpected inflation, change in real treasury bill yields, change in slope of the yield curve, and change in bond spreads.

That means, using those risk factors, you can uncover quite a bit about potential stock investing returns. However, the same risk factors that directly affect the stock market have almost no relationship with the real estate market.

Conclusion: Real Estate Investing and Stock Investing: Weighing Potential Risk Factors

What’s the key takeaway?

The lesson is that, if you are invested in a diversified stock portfolio, the stock market is still exposed to different risk factors than the real estate market. Without investing in an asset class that has a low correlation to the stock market – such as commercial real estate – your portfolio is not as diversified as it probably should be for capital preservation and better risk-adjusted returns.

Thank you for taking the time to read this

If you enjoyed reading this article, I’d love for you to subscribe to our monthly newsletter or share it with a friend!